FAQ About Stats related questions

What is a probability distribution?

A probability distribution is a function that assigns a probability to each possible outcome of a random variable.

What are the different types of probability distributions?

There are many different types of probability distributions, but some of the most common ones include:

* The normal distribution

* The uniform distribution

* The exponential distribution

* The Poisson distribution

* The binomial distribution

* The geometric distribution

What are the characteristics of a probability distribution?

A probability distribution must satisfy the following characteristics:

* The probability of each outcome must be between 0 and 1.

* The sum of the probabilities of all possible outcomes must equal 1.

How do you identify a probability distribution?

There are a few ways to identify a probability distribution:

* You can plot the probability of each outcome against the outcome itself. If the resulting graph is a smooth curve, then the distribution is likely to be a continuous distribution. If the resulting graph is a step function, then the distribution is likely to be a discrete distribution.

* You can calculate the mean and variance of the distribution. If the mean and variance are finite, then the distribution is likely to be a normal distribution.

* You can use statistical software to fit a probability distribution to the data.

What are the applications of probability distributions?

Probability distributions can be used in a variety of applications, such as:

* *In statistics:* Probability distributions can be used to analyze data and make inferences about the population from which the data was drawn.

* *In engineering:* Probability distributions can be used to design systems that are reliable and safe.

* *In finance:* Probability distributions can be used to model the risk of investments and make financial decisions.

* *In insurance:* Probability distributions can be used to estimate the cost of claims and set premiums.

* *In medicine:* Probability distributions can be used to model the spread of disease and develop treatment strategies.

Can you give an example of a real-world application of a probability distribution?

One real-world application of a probability distribution is in the insurance industry. Insurance companies use probability distributions to estimate the cost of claims and set premiums. For example, an insurance company might use the normal distribution to model the distribution of claims for car accidents. The mean of the distribution would represent the average claim amount, and the standard deviation would represent the variation in claim amounts. The insurance company could then use this information to set premiums that are high enough to cover the cost of claims, but not so high that they are unaffordable for customers.

How do you calculate the probability of an event under a probability distribution?

The probability of an event under a probability distribution can be calculated by finding the area under the distribution curve that is to the right of the event. For example, if you are using the normal distribution to model the distribution of claims for car accidents, and you want to calculate the probability of a claim that is $10,000 or more, you would find the area under the curve that is to the right of $10,000.

How do you fit a probability distribution to data?

There are a number of statistical methods that can be used to fit a probability distribution to data. One common method is called maximum likelihood estimation. This method finds the distribution that maximizes the likelihood of the data.

What are the challenges of fitting a probability distribution to data?

There are a number of challenges that can be encountered when fitting a probability distribution to data. Some of these challenges include:

* The data may not be a perfect fit for any single distribution.

* The data may be noisy, which can make it difficult to identify the true distribution.

* The data may be incomplete, which can also make it difficult to identify the true distribution.

How do you use probability distributions to make predictions?

Probability distributions can be used to make predictions about future events. For example, an insurance company might use the normal distribution to predict the number of claims that they will receive in the next year. The insurance company could then use this information to set premiums that are high enough to cover the cost of claims, but not so high that they are unaffordable for customers.

The central limit theorem (CLT)

The central limit theorem (CLT) states that, given a sufficiently large sample size from a population with any distribution, the arithmetic mean of the sample will be approximately normally distributed, regardless of the distribution of the population.

The CLT is a powerful tool that can be used to make inferences about populations from samples. It is used in a variety of applications, such as:

- Statistical inference: The CLT can be used to estimate population parameters, such as the mean and standard deviation.

- Hypothesis testing: The CLT can be used to test hypotheses about population parameters.

- Power analysis: The CLT can be used to determine the sample size needed to achieve a desired level of power in a hypothesis test.

- Monte Carlo simulations: The CLT can be used to generate random samples from a population.

The CLT is based on the following assumptions:

- The samples are independent.

- The samples are drawn from a population with finite mean and variance.

- The sample size is large enough.

The CLT is a powerful tool, but it is important to remember that it is only an approximation. The accuracy of the approximation depends on the sample size and the distribution of the population.

Here are some examples of how the central limit theorem is used in practice:

- An insurance company might use the CLT to estimate the average claim amount for a group of policyholders.

- A pharmaceutical company might use the CLT to test the effectiveness of a new drug.

- A pollster might use the CLT to estimate the percentage of voters who support a particular candidate.

The central limit theorem is a fundamental concept in statistics that is used in a wide variety of applications. It is a powerful tool that can be used to make inferences about populations from samples

what is the role of An actuary?

An actuary is a professional who applies mathematical and statistical methods to assess risk, price insurance premiums, and manage and regulate insurance and pension plans.

Actuaries use their skills to help businesses and individuals make informed decisions about risk. They do this by collecting and analyzing data, developing statistical models, and using their knowledge of probability and statistics to calculate the likelihood of future events.

Actuaries are employed by a variety of organizations, including insurance companies, pension funds, investment firms, and government agencies. They work in a variety of roles, including:

- Pricing: Actuaries use their knowledge of risk to price insurance premiums. They consider factors such as the likelihood of an event occurring, the severity of the event, and the cost of paying claims.

- Reserving: Actuaries estimate the amount of money that an insurance company needs to set aside to pay future claims. This is done by considering the number and severity of claims that have been paid in the past, as well as the expected number and severity of claims in the future.

- Investment: Actuaries help insurance companies invest their money in a way that minimizes risk and maximizes returns. They consider factors such as the expected return on investment, the risk of loss, and the liquidity of the investment.

- Regulation: Actuaries help governments regulate the insurance industry. They do this by developing and monitoring regulations that ensure that insurance companies are financially sound and that they are able to pay claims when they are due.

Actuaries are highly skilled professionals who play an important role in the financial industry. They use their knowledge of mathematics, statistics, and risk to help businesses and individuals make informed decisions about risk.

Here are some of the skills that an actuary needs:

- Strong mathematical and statistical skills: Actuaries need to be able to understand and apply complex mathematical and statistical concepts.

- Problem-solving skills: Actuaries need to be able to identify and solve complex problems.

- Communication skills: Actuaries need to be able to communicate their findings to a variety of audiences, including business executives, regulators, and the public.

- Critical thinking skills: Actuaries need to be able to think critically about the data and identify potential problems.

- Attention to detail: Actuaries need to be able to pay attention to detail and avoid errors.

If you are interested in a career in actuarial science, there are a few things you can do to prepare:

- Take math and statistics courses: These courses will give you the foundation in mathematics and statistics that you need to be an actuary.

- Get involved in actuarial clubs and organizations: These organizations can help you learn more about actuarial science and network with other actuaries.

- Pass the actuarial exams: The Society of Actuaries administers a series of exams that actuaries must pass in order to become certified.

If you are interested in a career in actuarial science, I encourage you to learn more about the profession and pursue the necessary education and training. Actuaries are in high demand and play an important role in the financial industry.

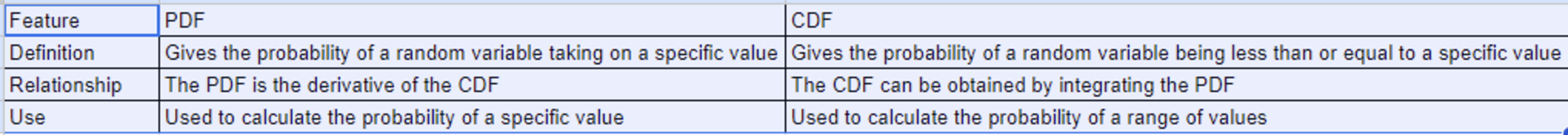

PDF vs CDF

The probability density function (PDF) and the cumulative distribution function (CDF) are two related but different ways of representing the probability distribution of a random variable.

The PDF is a function that gives the probability of a random variable taking on a specific value. It is often denoted by f(x). The CDF is a function that gives the probability of a random variable being less than or equal to a specific value. It is often denoted by F(x).

The PDF is defined as the derivative of the CDF. This means that the CDF can be obtained by integrating the PDF.

The PDF is used to calculate the probability of a random variable taking on a specific value. For example, if the PDF of a random variable is f(x), then the probability of the random variable being equal to 5 is given by:

P(X = 5) = f(5)

The CDF is used to calculate the probability of a random variable being less than or equal to a specific value. For example, if the CDF of a random variable is F(x), then the probability of the random variable being less than or equal to 5 is given by:

P(X < 5) = F(5)

The PDF and the CDF are both important tools for understanding the probability distribution of a random variable. The PDF is used to calculate the probability of a specific value, while the CDF is used to calculate the probability of a range of values.

Here is a table summarizing the key differences between the PDF and the CDF:

Markcov chain

A Markov chain is a stochastic process that satisfies the Markov property. This property states that the probability of a future state depends only on the current state, and not on the past states.

Markov chains are used in a variety of applications, including:

- Finance: Markov chains can be used to model the price of stocks and other financial assets., Car insurance etc

A Markov chain is a discrete-time stochastic process. This means that the states of the process are discrete, and the time between transitions is discrete.

The states of a Markov chain can be anything, but they are often numbers. For example, the states of a Markov chain that models the price of a stock could be the stock's price at the end of each day.

The transition probabilities of a Markov chain are the probabilities of transitioning from one state to another. For example, the transition probabilities of a Markov chain that models the price of a stock could be the probabilities of the stock's price increasing, decreasing, or staying the same.

The Markov property states that the probability of a future state depends only on the current state, and not on the past states. This means that the past states are irrelevant to the future states, given the current state.

The Markov property is a powerful tool that can be used to simplify the analysis of Markov chains. It allows us to ignore the past states and focus on the current state.

There are two types of Markov chains:

- Discrete-time Markov chains: These chains have a discrete number of states and a discrete time step.

- Continuous-time Markov chains: These chains have a continuous number of states and a continuous time step.

Discrete-time Markov chains are more common than continuous-time Markov chains. They are easier to analyze and simulate.

Markov chains are a powerful tool that can be used to model a variety of phenomena. They are used in a variety of applications, including finance, engineering, medicine, and computer science.

A stochastic process

A stochastic process is a collection of random variables indexed by time. It is a mathematical model that describes the evolution of a random phenomenon over time.

Stochastic processes are used in a variety of applications, including:

- Finance: Stochastic processes can be used to model the price of stocks and other financial assets.

There are two main types of stochastic processes:

- Discrete-time stochastic processes: These processes have a discrete number of states and a discrete time step.

- Continuous-time stochastic processes: These processes have a continuous number of states and a continuous time step.

Discrete-time stochastic processes are more common than continuous-time stochastic processes. They are easier to analyze and simulate.

Here are some of the most common stochastic processes:

- Markov chains: Markov chains are stochastic processes that satisfy the Markov property. This property states that the probability of a future state depends only on the current state, and not on the past states.

- Poisson processes: Poisson processes are stochastic processes that model the occurrence of events over time. The number of events that occur in a given time period follows a Poisson distribution.

- Brownian motion: Brownian motion is a stochastic process that models the random motion of particles. It is used in a variety of applications, including finance and physics.

- Geometric Brownian motion: Geometric Brownian motion is a stochastic process that models the growth of a financial asset. It is used in a variety of applications, including finance and economics.

Stochastic processes are a complex topic, but they are a powerful tool that can be used to model a variety of phenomena. If you are interested in learning more about stochastic processes, there are many resources available online and in libraries.

Term structure of interest?

The term structure of interest rates is the relationship between the interest rates on bonds of different maturities. It is a graphical representation of the yields on bonds with different maturities plotted against their maturities.

The term structure of interest rates is important because it shows how investors perceive the risk of lending money for different periods of time. If investors believe that there is a high risk of inflation in the future, they will demand a higher interest rate on long-term bonds than on short-term bonds.

There are three main theories that explain the term structure of interest rates:

- The expectations theory: This theory states that the yield curve is determined by investors' expectations of future interest rates. If investors expect interest rates to rise in the future, they will demand a higher interest rate on long-term bonds than on short-term bonds.

- The liquidity preference theory: This theory states that the yield curve is determined by the liquidity of different bonds. Long-term bonds are less liquid than short-term bonds, so investors demand a higher interest rate on long-term bonds to compensate for the risk of illiquidity.

- The segmented market theory: This theory states that the yield curve is determined by the supply and demand for different bonds. If there is more demand for long-term bonds than supply, the yield curve will be upward sloping. If there is more supply of long-term bonds than demand, the yield curve will be downward sloping.

The term structure of interest rates is a complex topic, and there is no single theory that can fully explain it. However, the three theories discussed above provide a good starting point for understanding how the term structure is determined.

Here are some of the factors that can affect the term structure of interest rates:

- Inflation expectations: If investors expect inflation to rise in the future, they will demand a higher interest rate on long-term bonds than on short-term bonds.

- Liquidity preference: Long-term bonds are less liquid than short-term bonds, so investors demand a higher interest rate on long-term bonds to compensate for the risk of illiquidity.

- Supply and demand: If there is more demand for long-term bonds than supply, the yield curve will be upward sloping. If there is more supply of long-term bonds than demand, the yield curve will be downward sloping.

- Central bank policy: The central bank can affect the term structure of interest rates by changing the short-term interest rate. If the central bank raises the short-term interest rate, it will cause the yield curve to steepen. If the central bank lowers the short-term interest rate, it will cause the yield curve to flatten.

The term structure of interest rates is a dynamic market phenomenon and it can change over time. It is important to monitor the term structure regularly to understand how it is affecting the cost of borrowing and investing.

what are spot rates?

In finance, a spot rate is the current market price of a financial instrument that is to be delivered immediately. It is the price at which two parties agree to trade an asset for cash today.

For example, if you want to buy a bond that matures in one year, the spot rate is the price that you would pay for the bond today. The spot rate is also known as the cash price or the immediate price.

The spot rate is different from the forward rate. The forward rate is the price at which two parties agree to trade an asset for cash at a future date. The forward rate is used to price derivatives, such as futures contracts and options.

The spot rate is determined by the supply and demand for the financial instrument. If there is more demand for the instrument than supply, the spot rate will go up. If there is more supply than demand, the spot rate will go down.

The spot rate is an important benchmark for the pricing of financial instruments. It is also used to calculate the yield of a financial instrument.

Here are some of the uses of spot rates:

- Pricing of financial instruments: The spot rate is used to price a variety of financial instruments, such as bonds, currencies, and derivatives.

- Calculation of yield: The spot rate is used to calculate the yield of a financial instrument, such as a bond.

- Hedging: The spot rate can be used to hedge against the risk of changes in interest rates or exchange rates.

- Investment decisions: The spot rate can be used to make investment decisions, such as when to buy or sell a financial instrument.

The spot rate is a dynamic market price and it can change over time. It is important to monitor the spot rate regularly to make sure that you are getting the best possible price for your financial transactions.

An arbitrage opportunity?

An arbitrage opportunity is a situation where you can make a profit without taking any risk. It occurs when there is a difference in the price of an asset in two different markets.

For example, suppose the price of a stock is $100 in the United States and $105 in Japan. You could buy the stock in the United States and sell it in Japan, making a profit of $5 per share.

Arbitrage opportunities are rare, but they can be profitable if you can find them. However, they are also risky, as the prices of assets can change quickly.

Here are some of the factors that can create arbitrage opportunities:

- Market inefficiencies: If there is a difference in the price of an asset in two different markets, it is possible that there is an arbitrage opportunity. This could be due to a lack of information or a lack of liquidity in one of the markets.

- Currency fluctuations: If the exchange rate between two currencies changes, it can create an arbitrage opportunity. For example, if the euro depreciates against the dollar, you could buy euros in the United States and sell them in Europe, making a profit.

- Futures contracts: Futures contracts are agreements to buy or sell an asset at a future date. If the price of the asset changes between the time the contract is made and the time it is settled, it can create an arbitrage opportunity. For example, if the price of oil futures contracts goes up, you could buy the contracts and then sell the oil at the spot price, making a profit.

Arbitrage opportunities are often short-lived, as traders will quickly take advantage of them and the prices will converge. However, they can be profitable if you can find them and act quickly.

Here are some of the risks associated with arbitrage opportunities:

- Market volatility: The prices of assets can change quickly, which can make it difficult to take advantage of an arbitrage opportunity.

- Transaction costs: There are often transaction costs associated with trading assets, which can eat into your profits.

- Liquidity: If the market for an asset is illiquid, it can be difficult to sell the asset quickly, which can also reduce your profits.

If you are considering taking advantage of an arbitrage opportunity, it is important to carefully consider the risks involved.

IRR vs XRR

Internal rate of return (IRR) and extended internal rate of return (XRR) are both methods used to calculate the profitability of an investment. However, there are some key differences between the two methods.

IRR is the discount rate that makes the net present value (NPV) of an investment equal to zero. It is calculated by discounting all of the cash flows from an investment back to the present and then finding the rate that makes the sum of the discounted cash flows equal to zero.

Type of interest rates?

- Annual Effective interest rate - expresses the amount of interest as a percentage of the balance at the start of the period

- Annual Effective discount rate - the amount of interest paid or earned as a percentage of the balance at the end of the annual period.

- Continuous interest rates - Effective interest rates when compounding is happening every moment in time

- Nominal Rates compounding p times - i(p)/p -- The nominal interest rate is the interest rate that is stated on a loan or investment. It is the percentage of the principal that is paid in interest each year. The nominal interest rate is not the same as the effective annual rate (EAR). The EAR takes into account the effects of compounding, which means that interest is earned on interest. The EAR is always higher than the nominal interest rate.

All the bank publish interest rates are nominal Annual rates compounded monthly.. e.g. 21% p.a mean monthly 21%/12

--First calculate the yearly effective rates by (1+r/12)^12-1 , then calculate the EMI based on no. of months of EMI

v = 1/(1+i) -- i is yearly effective interest rate , formula - (1-v^n)/i1